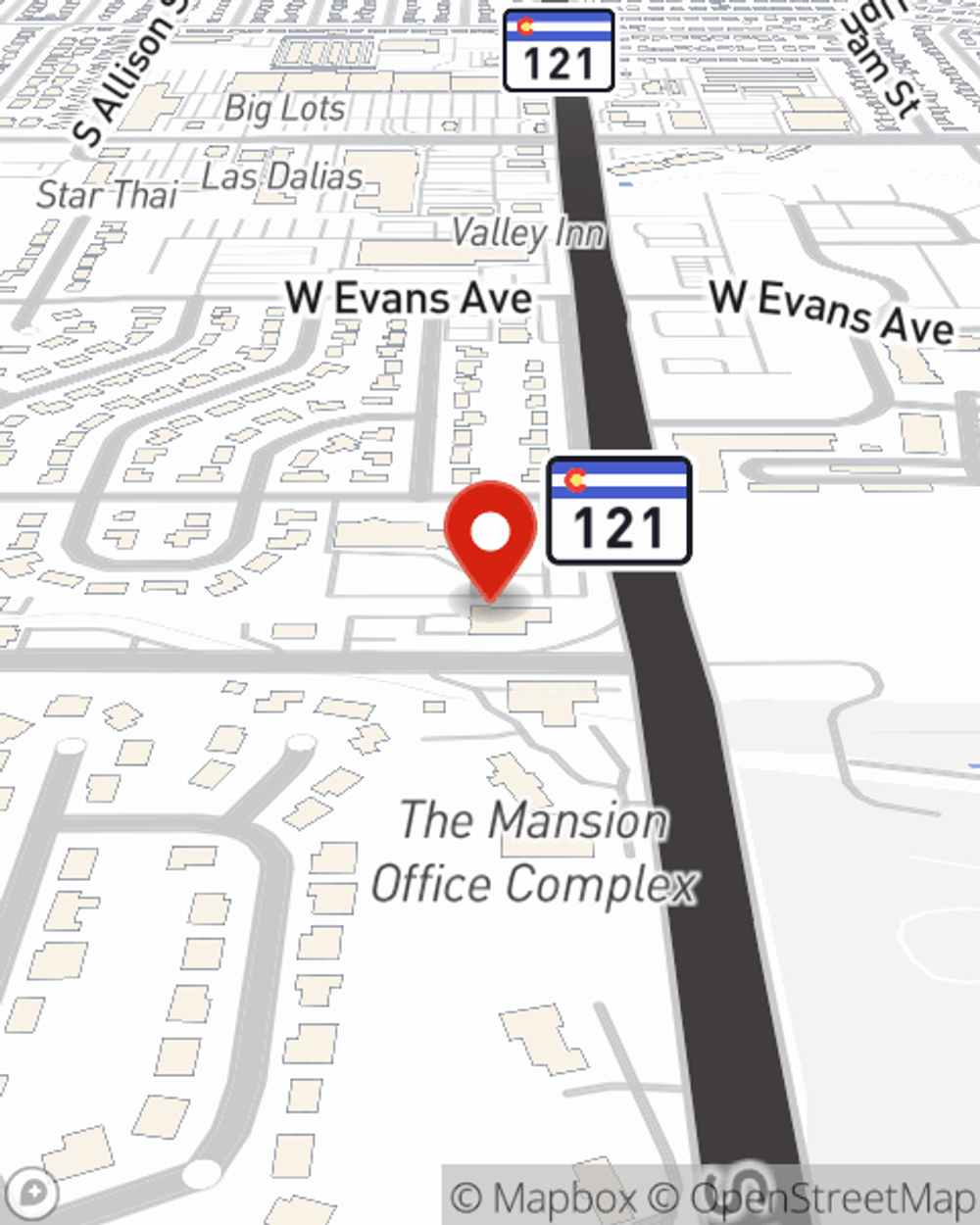

Renters Insurance in and around Lakewood

Welcome, home & apartment renters of Lakewood!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Lakewood

- Littleton

- Golden

- Morrison

- Evergeen

- Conifer

- Wheat Ridge

- Englewood

- Denver

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a townhome or a condo, protection for your personal belongings is a good precaution, especially if you own items that would be difficult to fix or replace.

Welcome, home & apartment renters of Lakewood!

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a property or space, you still own plenty of property and personal items—such as a a video game system, set of golf clubs, TV, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why purchase your renters insurance from Dennis Sullivan? You need an agent who can help you choose the right policy and examine your needs. With efficiency and wisdom, Dennis Sullivan stands ready to help you keep life going right.

A good next step when renting a home in Lakewood, CO is to make sure that you're properly insured. That's why you should consider renters coverage options from State Farm! Call or go online now and see how State Farm agent Dennis Sullivan can help you.

Have More Questions About Renters Insurance?

Call Dennis at (303) 586-4504 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Dennis Sullivan

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.